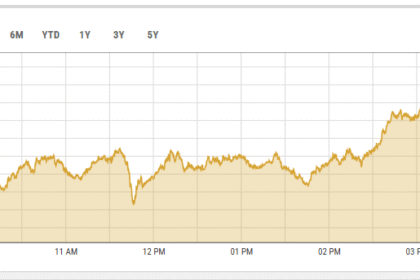

On January 27, 2025, the State Bank of Pakistan (SBP) reduced its key policy rate by 100 basis points, bringing it down to 12%. This marks the sixth consecutive rate cut since June 2024, totaling a cumulative reduction of 1,000 basis points from a peak of 22%.┬Ā

SBP Governor Jameel Ahmed highlighted that the decision was influenced by a downward trend in inflation, which reached 4.1% year-on-year in December 2024. He noted that while overall inflation is decreasing, core inflation remains elevated. The governor also pointed out positive trends in remittances and exports, contributing to a current account surplus in December 2024. Despite these improvements, he emphasized the need for a cautious monetary policy to maintain price stability and support sustainable economic growth.┬Ā

The SBP maintains its forecast of achieving $13 billion in foreign exchange reserves by the end of June 2025. Additionally, the central bank projects full-year GDP growth to be between 2.5% and 3.5%.┬Ā

This series of rate cuts is among the most aggressive monetary easing measures by central banks in emerging markets, aiming to stimulate economic activity amid easing inflationary pressures.┬Ā