If I were told four months ago that the U.S. would slap a sweeping 10% tariff on all imports—like a toddler throwing a tantrum over too many foreign toys—I might have laughed it off as another election season gimmick. Yet here we are, watching the world’s largest economy retreat behind a wall of protectionism, leaving vulnerable nations like Pakistan scrambling to assess the fallout. And because we are special, we have managed to bag a 29% tariff instead. At least there is one arena Pakistan seems to be leading in, albeit not so proudly.

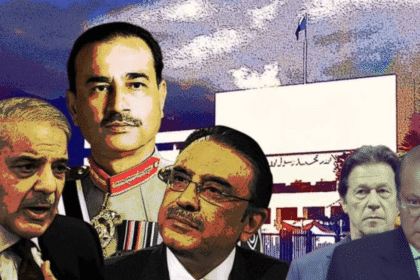

At first glance, tariffs sound simple: make foreign products expensive, force people to rely on local production (even if that includes Elon Musk’s failed high school projects like Tesla), and create jobs. But the beauty of economics lies in its stubborn adherence to theory, and the reality isn’t as straightforward as the group chats in Washington claim it to be. History has a habit of proving that trade wars rarely have winners, but in the case of Pakistan—a country already drowning under the weight of new IMF loans to fund the fascist regime’s Hermès collections, a precarious balance of payments, an overreliance on the textile industry, and a currency that fluctuates more than the current federation’s narratives—this latest move from the U.S. is a direct strike at an already fragile economy.

So what does this mean for Pakistan? Let’s break it down.

Firstly, our already struggling export sector is about to take another hit. The U.S., alongside China and the UK, forms one of Pakistan’s largest trading partners, with textiles and apparel constituting the bulk of our exports. A 29% tariff means that Pakistani goods will become significantly more expensive for American businesses and consumers, which is a financial chokehold for an industry already battling energy shortages, high production costs, lack of modernization, and wavering global demand. Ultimately, this tax could be the final straw that pushes producers to either shut down production or relocate elsewhere, both of which are terrible odds as far as Pakistan’s economy is concerned.

The irony is that while the U.S. claims to be the champion of fair trade, policies like these do little but shift market dynamics toward low-cost producers like India, Bangladesh, and Vietnam. The result is seen in these countries replacing the gaps left by Pakistan’s now uncompetitive products and sidelining an already marginalized economy. The final nail in the coffin will be pushed by our own government, eager not to counter these reforms through retaliatory tariffs or, God forbid, NATO blockages, but through more desperate meeting rooms with the IMF to add to the bulging debt.

The truth is, these shockwaves will rarely restrict themselves to the textile industry. As exports fall, the excess supply created will not only worsen the trade balance (which, to be fair, never recovered after the 2022 regime change) but also push the inflation rate toward hyperinflation, causing the rupee to plummet more than was assumed possible. As prices rise, basic necessities like groceries become more unattainable, and the poverty levels consuming a significant proportion of the population will transform into vicious cycles. While Pakistan isn’t exactly in the position to slap tariffs on the U.S. in response (a move that this writer highly encourages), it could find itself caught in the crossfire of collateral damage in the broader U.S.-China hostilities, rendering us immovable in our own region.

The real question is: what is Pakistan’s plan? So far, the regime’s response has been a mix of loans, denials, and prayers. Allegedly providing PKR 2,000 on a PKR 40,000 income does not fill the absence of a social security net, just like a Nawaz Sharif IT City doesn’t solve the economic downturn caused by the artists of the project. There was a reason the Ehsaas Program helped Pakistan rank fourth best by the World Bank for its social protection response to COVID-19.

If Pakistan wants to stay within the global market, it needs to diversify its exports, create a progressive tax system that actually works, invest in domestic industries (and not by plastering a face), and find new allies in the grand potential that Russia and the Central Asian region possess. If we continue to solve our temporary economic setbacks by putting up Balochistan’s natural reserves for sale, we will soon realize that while we are stuck playing checkers, the world has already moved on to chess.

As a fool once said: Beggars can’t be choosers. And when the board is finally cleared, it won’t be about winning or losing—it will be about whether we even have a seat at the table.