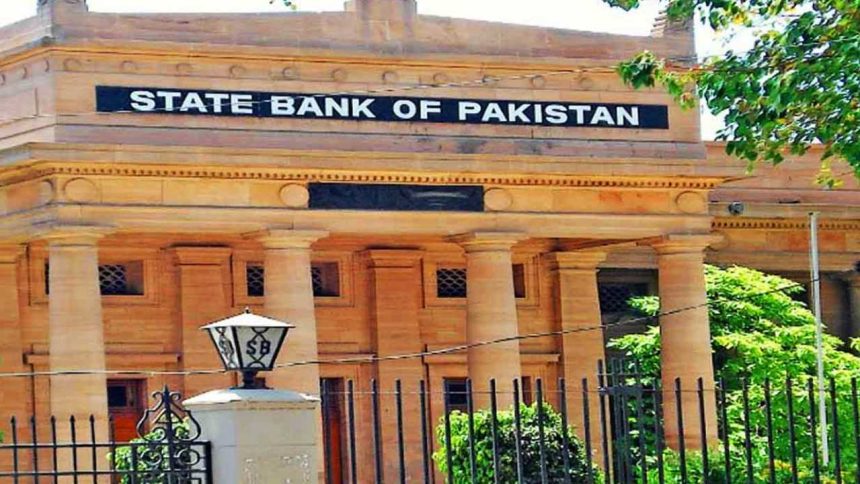

Pakistani commercial banks have dramatically increased lending to the government, with outstanding loans crossing Rs 44 trillion by June 2025. This spike follows the government’s withdrawal of a policy that had previously mandated a minimum advance-to-deposit ratio (ADR) of 50%; banks, wanting to avoid penalties tied to that rule, aggressively extended credit—primarily through treasury bills and bonds which led the investment-to-deposit ratio (IDR) to reach 103%. With the ADR now lowered to 38.1%, private-sector lending has taken a steep hit, as banks shifted focus toward risk-free government securities.

Bank Lending to Government Surpasses Rs 44 Trillion

Leave a comment

Leave a comment